QuickBooks Self-Employed (QBSE) is NOT for Photographers

Related Posts:

👉 QuickBooks ONLINE for Photographers (#AllTheThings)

When you mention QuickBooks, you have to clarify which, as there are still so many versions. Believe it or not, the archaic desktop version still exists, then there's QuickBooks Online, which at the time of this post offers four versions (three of which I can get you special pricing on - Learn more here.)

...Then there's good ole' QuickBooks Self-Employed...

I find many Photographers enroll in QuickBooks Self-Employed and end up super frustrated, and I would like to show you why.

Who is QuickBooks Self-Employed for?

QuickBooks Self-Employed is for those who are self-employed, yes, but not in the way you would think. Unfortunately, self-employed is a broad term these days. QuickBooks Self-Employed is for freelancers and those participating in the gig economy. These are self-employed individuals contracting work with others rather than growing their own business. QuickBooks Online tries to call out the difference between freelancers and small businesses on their sign-up page to steer users in the right direction but, it doesn't always work. (See image below)

QuickBooks Self-Employed allows those on the go, taking jobs here and there, to keep track of their income and tax implications of that self-employed income. They can track mileage inside the app and use one bank account to split transactions, and it calculates estimated tax payments based on input (if it's correct), but that's about the extent of it.

Photographers ask me all the time to explain why they shouldn't use QuickBooks Self-Employed

You asked for it, so let's dive in!

👎No Integration with Third-Party Apps

Yup, that's right, QuickBooks Online integration with thousands of apps like 17Hats, HoneyBook, Dubsado, Paypal, Square, to name a few popular ones. Quickbooks Self Employed DOES NOT integrate with anything.

👎No Tracking Sales & Sales Tax

QuickBooks Self-Employed tracks income from services you sell but DOES NOT track or calculate sales tax for you. QuickBooks Online tracks sales and calculate sales tax for you, and creates beautiful sales tax liability reports for you to use when it is time to file.

Be sure to grab your State by State Sales Tax Guide here!

👎No Tracking or Preparing 1099's

QuickBooks Self-Employed DOES NOT allow you to have vendors, just transaction descriptions and categories. If you pay a makeup artist, hairstylist, second shooter, or editor, anyone you contract, you cannot track what you pay them in QuickBooks Self-Employed. QuickBooks Online is slick and not only tracks these payments but also allows you to file your 1099's at year-end right inside the app.

👎No Recurring Transactions

QuickBooks Self-Employed DOES NOT support recurring transactions. However, QuickBooks Online allows you to do this for any transactions. Maybe you have a recurring expense you don't want to forget, or you can set up recurring invoices to bill your clients monthly or on a schedule. You can take it a step further with QuickBooks Payments (see below) and set your clients up on Auto Debit that recurs on its own on a schedule.

👎No Managing and Paying Vendor Bills

QuickBooks Self Employed only allows you to categorize expenses as they come in. You CANNOT enter a bill and pay it later as you can in QuickBooks Online. Entering bills now to pay later creates an Accounts Payable. QuickBooks Self Employed does not handle this.

👎Very Limited Reporting

There are only a handful of reports, mostly summarizing features in QuickBooks Self-Employed like Mileage Summary, etc. The only financial statement you can pull from QuickBooks Self-Employed is a Profit & Loss statement. There's no balance sheet and no other financial statements available. Because you CANNOT reconcile (see below), It's hard to know if these reports are accurate.

👎No Way to Reconcile Transactions

Reconciling is the biggest reason I encourage you not to use QuickBooks Self-Employed for your Photography business. You CANNOT reconcile the books. Without a reconciliation process, there's no way to ensure every transaction has been accounted for and nothing is duplicated. Reconciling accounts is a monthly bookkeeping task you CANNOT do in Quickbooks Self Employed. You never know if there is a hiccup where something is skipped or gets entered twice because of your downloading transactions. You have no way of making sure the figures you are using to file taxes are accurate, resulting in you under or overpaying taxes.

👎No Payroll

Let's say you're experiencing growth and want to hire someone, or heck, let's say you just elected S-Corp status to save tons on your taxes. You have to be on the payroll. QuickBooks Self-Employed does not support this - QuickBooks Online has an entire payroll system nestled beautifully inside of it.

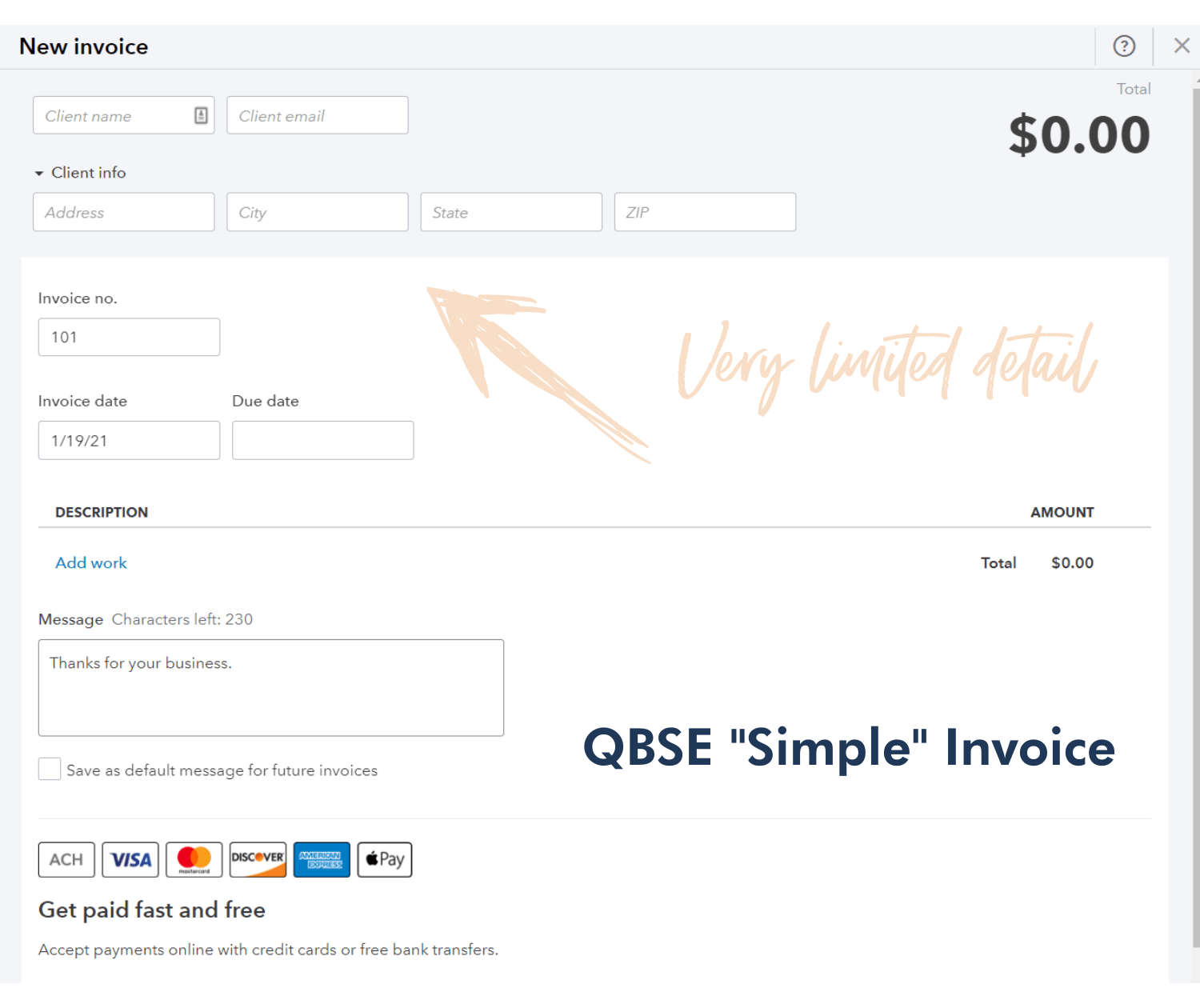

👎Limited Invoicing

Sure, you can create invoices in QuickBooks Self Employed, but they only support "Simple" Invoices. "Simple" means you CANNOT customize the design in any way. You DO NOT have Customers or Items. No Customers or Items makes it hard to view how much you received from a particular customer or a specific item, like a photography package. The simple invoice is the client name and description of work and amount. Simple invoices are lacking on so many levels. (see image below)

👎No Chart of Accounts

Ok, I realize chart of accounts is one of those foofy accounting terms but having one is nice. A chart of accounts allows you to break up your profit and loss report to see what you spend on prints and albums or paid to contracted makeup artists. A chart of accounts allows you to customize the rows you see on your profit and loss, so you have the visibility behind your income and expenses you need to make business decisions.In QuickBooks Self-Employed, you only get the "tax" categories they give you. You do not get to make your own accounts or view your P & L in any way that can help you make better business decisions and really see where your money is going.

💸You get what you pay for

I tell photographers that although I am an Intuit Advanced QuickBooks ProAdvisor, I honestly feel that QuickBooks Self Employed provides half the product for half the price (you get what you pay for).

However, If you have a side gig for extra cash or make ends meet and you're NOT building a business, this QuickBooks Self Employed is truly built for you!

I rarely find this is the case for a Photographer.

If you want to learn more about why I use QuickBooks ONLINE for photographers check out this blog post: QuickBooks Online for Photographers (#allthethings)

🎁Get my discount & get organized

I hope you’re now ready to dive in and finally get your finances organized.You can use the link below to get 50% off your subscription for the first year!

⭐️50% off QuickBooks Online for 12 Months ← Click to watch

Have another question you’d like me to add to this list?

Click here to join my free Facebook Community Financially Focused Photographers

I go live in this community every week answering all your tax, bookkeeping, and tax questions. Be sure to follow me on Instagram, Facebook, YouTube, and Pinterest.