Standard Deduction Versus Itemized Deduction

I feel like tax pros toss these terms around and many photographers sort of glaze over and nod never really knowing what exactly all of this means.Knowledge is power my friends, and I am here to empower you! So let's dive in.So...What is the standard deduction? What does it mean to itemize deductions?What is the difference between both of them? More importantly, how do you know which one you should take?I’m going to break it all down for you and walk you through the standard deduction and itemizing deductions. So you have a base understanding and can compare for yourself.

The 1040 - Individual Income Tax Return

Let’s start from the very beginning...Everyone in the United States files a 1040 tax return on the federal level. So, let’s take a look at the form 1040 so you have a visual of what we’re talking about. The form 1040 is two-pages. On page 1, (line 9 for 2019 - Note the line number may change from year to year but the name of the line will always be the same) Looking at the image below you can see it calls for you to decide if you are using the standard deduction or the itemized deduction this will most likely be the largest deduction on your tax return which is why it is crucial to understand when to pick standard or itemized deduction based on your tax situation.

Standard Deduction

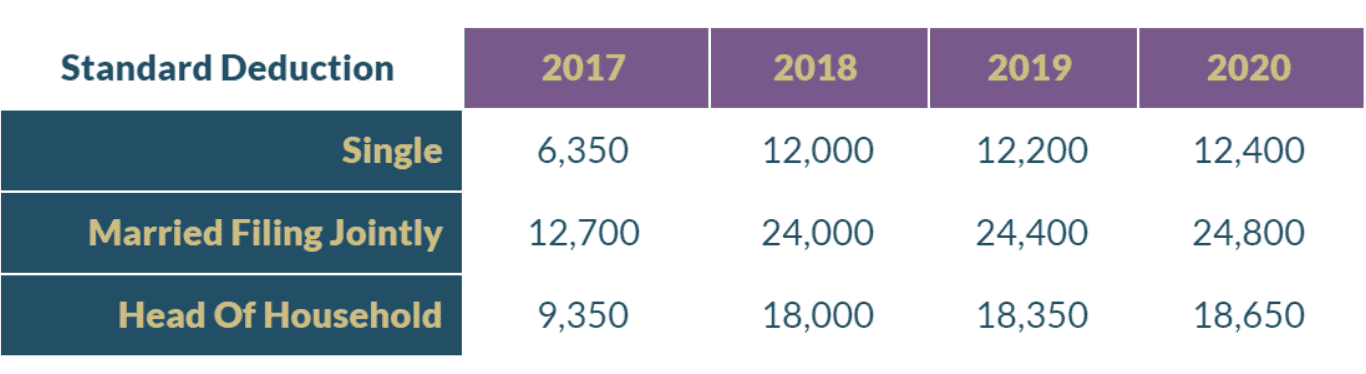

The standard deduction is a flat fixed amount based on your filing status. It’s important to note the standard deduction increases a little bit each tax year. You should also be aware the standard deduction doubled in 2018 with new tax laws. The standard deduction is higher now than it has ever been, making it hard to know if you should take the time to try to figure out if you should itemize or not.Below are the standard deductions for 2017-2020.

Itemized Deduction

The Itemized Deduction is a calculation of various deductions where your filing status does not matter. All of these calculations will come from Schedule A which we will get into shortly.Basically, you’ll want to add up your itemized deductions and compare them against the standard deduction for your filing status to see which one is larger and that is the one you’ll take.

Schedule A - Itemized Deductions

We know the standard deduction is a flat fixed amount so let’s take a look at what gets calculated into an itemized deduction. This all happens on Schedule A. Let’s break out schedule A by section.

Medical and Dental Expenses

This includes a laundry list of out of pocket medical expenses but DOES NOT include medical insurance premiums. It does include things like medical, dental, and vision copays, etc along with medical mileage. However, you can only deduct the amount of your medical and dental expenses that is more than 7.5% of your AGI currently and that number goes up for 2020 to 10% of AGI. 2020. You’ll need the actual receipts on file to back up any of the expenses claimed.

Taxes You Paid

First, you have to pick between deducting state and local income tax or state and local sales tax.

State and Local Income Tax

This includes state and local taxes you’ve had withheld from your paycheck or you’ve paid as an estimated payment.

State and Local Sales Tax

This can include state and local sales tax paid on food, clothing, medical supplies, and motor vehicles.

State and Local Real Estate Taxes

Then you can also deduct any state and local real estate taxes paid on any real estate property you own.

State and Local Personal Property Tax

This is personal property taxes you paid to the state based on value. For example, maybe, you pay a yearly registration fee to the state for your vehicle. Whatever part of your fee is based on the value of the vehicle, this portion can be deducted. However, if your registration is based on the weight of the vehicle, this portion is not deductible.Just like any other tax deduction, you’ll need all receipts on file to back up any of the expenses claimed. 2018 tax law changes add a limit to this deduction - it is now capped at $10,000 per return.

Other Taxes (Not capped at 10K per return)

The very last line in this section of Schedule A is not included in the amount to cap at 10,000 However, this is rarely used on most returns, but this would include any taxes paid to a foreign country and any generation-skipping tax (GST) imposed on certain distributions.

Interest You Paid

Home Mortgage Interest and points

If you own a home and are paying a mortgage, you know that the largest amount of most of your payments for many years is the interest. You can deduct both the interest and points of any loan securing your main home and a second home. This includes first and second mortgages, home equity loans, and refinanced mortgages.

Home Mortgage Insurance Premiums

You can deduct mortgage insurance premiums for any mortgage issued after 12/31/2006. However, be aware this deduction phases out once your adjusted gross income (AGI) hits 100K.

Investment Interest

This includes interest paid on money borrowed that was used to purchase property for investment purposes. For example: an equity loan on your home to buy stock. You could not deduct interest on the equity line under mortgage interest because it is not securing a first or second home. But, you can deduct it under investment interest.

Gift to Charity

You can deduct gifts/donations of property or cash to an IRS qualified charitable organization as long as you have receipts and records of all donations. You should know that there are limitations on charitable donations (most will be limited at 50%). The IRS states “certain private foundations, veterans organizations, fraternal societies, and cemetery organizations are limited to 30 percent adjusted gross income (AGI).

Casualty and Theft Losses

You can deduct theft or losses related to your home, household items and vehicles resulting from a federally declared disaster that has been officially declared by the President. For an example of when this deduction would apply, think back to Hurricane Katrina. Many were able to take this deduction for the loss of property from the officially declared disaster.

Other Itemized Deductions

This includes things like gambling losses (You can only deduct your gambling losses up to your winnings). Loss from other activities from Schedule K-1, and Federal estate tax on income in respect of a decedent.

Total Itemized Deductions

This is where we total everything up and then compare this to our standard deduction to see which one gives us a larger deduction.

When should I think about Itemizing?

As you can see there is definitely some work that goes into tracking over the tax year and calculating the itemized deduction. You may do all the work only to find out that the standard is still much higher. There are a few things that can help you decide if it is worth tracking and calculating.

If you own a home, or even better you own a first and second home, if you have made large donations to qualified charitable organizations and have a higher amount of Medical out of pocket expenses and are in a lower tax bracket this may make sense to take the time to figure out if Itemized deductions can save you money.

If you want the video version of this blog post, linked at the top I walk through an example with real numbers so you can see the whole thing in action!

Click here to join my free Facebook Community Financially Focused Photographers

I go live in this community every week answering all your tax, bookkeeping, and tax questions!

Be sure to follow me on Instagram, Facebook, YouTube.

If you’re ready to get your financial sh!t together --> WORK WITH US!

RESOURCES

IRS Publication 502 Medical and Dental Expenses

IRS 2019 Instructions for Schedule A

IRS Publication 526 Charitable Contributions

IRS Charitable Organization Search

Photo by Monika Stawow on Unsplash