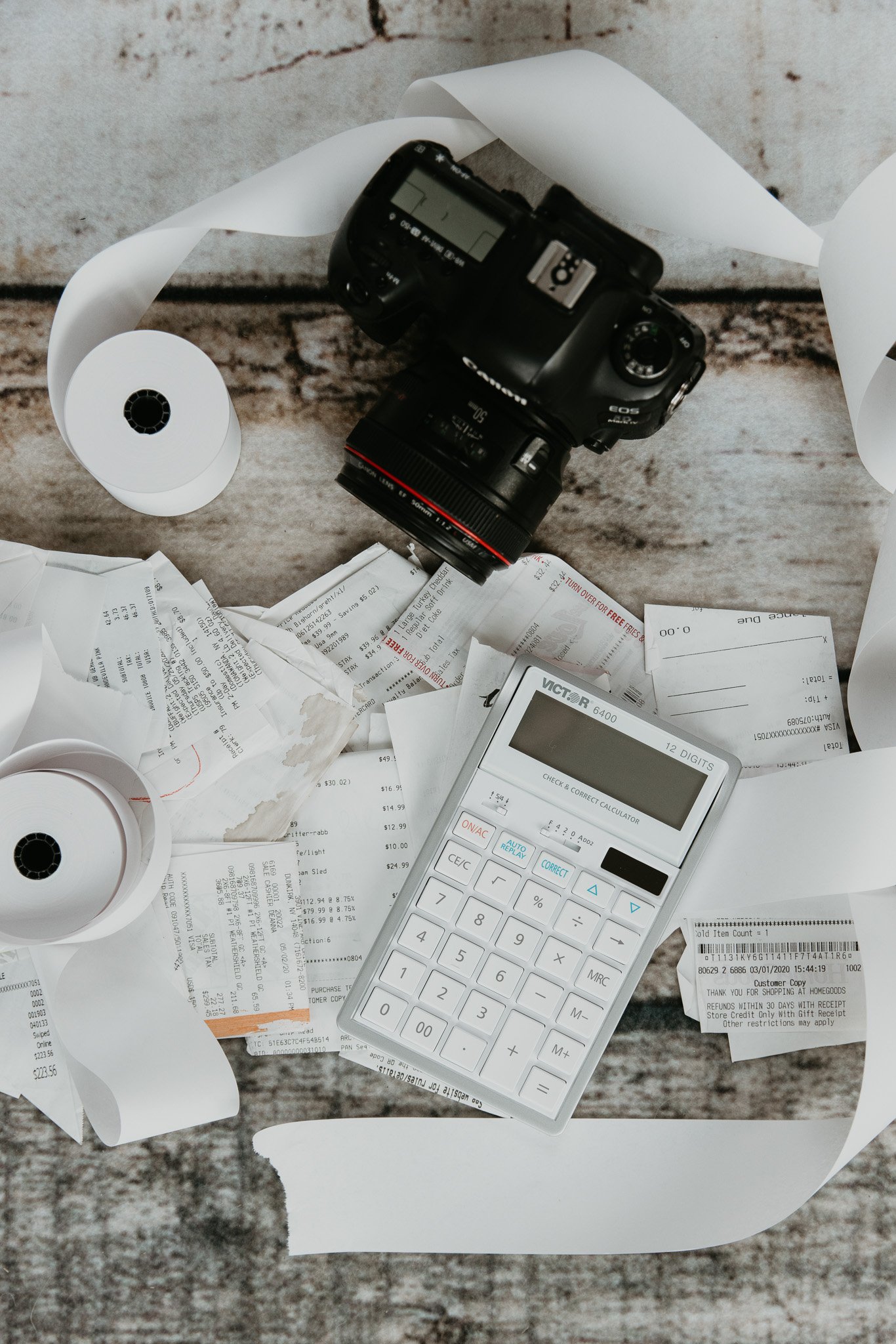

You’re the Photographer

Let us be the Accountant

You got into photography to capture beautiful moments. You love the art and lighting and swoon over a good backdrop. Yet, instead of focusing on your amazing clients or delivering those freshly edited digital memories, you find yourself tangled in the weeds…

You're trying to figure out how to manage sales tax and stay compliant with your contractors. Your bookkeeping is a nightmare, and you don’t even want to talk about filing your taxes.

The accounting side of your business is draining the life out of your passion for photography.

Bastian Accounting is here to alleviate your bookkeeping and tax frustrations, allowing you to keep more of your hard-earned income, gain a comprehensive understanding of your business financials, and return to expanding your business and serving your clients without the burden of financial anxiety.

Building Client Relationships

Collaborative Partnership:

We prioritize collaboration over mere number-crunching. We engage with you to understand your business intricacies, review financial records together, and discuss insights and improvements. This hands-on approach fosters transparency, trust, and informed decision-making, empowering you to drive your business forward with confidence.

Open Communication:

Communication is the cornerstone of any successful relationship. Unlike the stereotypical image of a distant CPA, we prioritize open and transparent communication. We're not just your accountants; we're here to answer your questions, address your concerns, and keep you informed every step of the way.

Educational Empowerment:

We believe in empowering our clients with knowledge. Unlike the average CPA, who might leave you in the dark, we take the time to educate you about your finances. Understanding the intricacies of your tax situation and financial decisions is key to building a strong and informed client relationship.

Accessibility and Responsiveness:

The days of struggling to get in touch with your accountant are over. We prioritize accessibility and responsiveness. We’re your go-to financial allies, readily available to discuss your concerns and collaborate on your financial goals.

Tailored Support:

We recognize that every client is unique. Unlike your parents' accountant or the average CPA who might offer generic solutions, we provide tailored support. Your goals, challenges, and aspirations are at the forefront of our approach, ensuring our services align seamlessly with your individual needs.

At Bastian Accounting, we pride ourselves on redefining the way client relationships are built. We understand that the typical client-accountant dynamic may feel distant, impersonal, or reminiscent of the traditional accountant your parents may have worked with. Here's how we stand out from the crowd:

The Bastian Accounting Difference

Say goodbye to the distant, unengaged accountants of the past.

Bastian Accounting is not your average Accounting firm; we're committed to building meaningful, collaborative, and empowering client relationships.

Why Photographers Trust Us

Serving photographers exclusively allows us to offer heightened service and expertise whether you are just starting or are a seasoned professional.

We offer support every step of the way and understand the intricacies of the photography industry like no one else. We can help you navigate fluctuating income streams and maximize deductions.

We specialize in understanding the nuanced sales tax laws for photographers in every state, ensuring you stay compliant and avoid surprises.

We handle contractor compliance (W-9/1099) for anyone you paid who is not an employee.

(ie, second shooters, business coaches & HMUA’s, to name a few)We ensure your business is structured properly (Sole proprietor, LLC, S-Corp, etc.) for ultimate tax savings

Our tailored approach ensures that every aspect of your financial journey is optimized for success. We do all of this so you can focus on capturing unforgettable moments for your clients without financial stress.

Join us today, and let's turn your passion into profit, one snapshot at a time click the link below to book a call so we can discuss how we can work together.

What Photographers Are Saying…

"My biggest struggle was making sure that my business expenses and accounts were correct and everything was in line with the state. Since working with Tiffany, so much stress has been taken off my shoulders, which has given me time to focus on things in my business that I actually like doing! I feel amazing because I know everything is all in place on the back end! TIFFANY IS AMAZING! I am so glad I found her, and I can't wait to continue working” together!"

Sarah Carter | Southern Rose Studio

"During my first phone call with Tiffany, I knew that she was exactly the person I was looking for! I immediately felt cared for and confident in her knowledge as an expert in her field; I know that I can turn to her with the five million questions I always have spinning in my head and that she will always be on it to help me fix whatever issue at hand and thrive. I feel so at peace knowing that my business is in great hands! Because of this, I can now focus on other parts of my business that I love!"

Kelly Marcelo | Kelly Marcelo Photography

"Before working with Tiffany, my finances and budgeting were a disaster. All clumped together I had no idea where the money was going. Tiffany makes it very easy to see if you’re in the negative or on the road to growth. Which in turn helps me budget accordingly. She is always available for any questions I have. She gets it. She knows the ins and outs of what we do and how it works. Everyone else I’ve ever worked with just never really understood what I do. It’s nice to have someone focused on just photographers. She also acts like a human and not a business”

Katie Miller | K T Miller Photographer

"Communication! Tiffany and her team really have this nailed down. Their systems and workflows make it easy for me as a business owner to quickly and easily provide them with what they need to keep my accounts in check. I can count on getting a thorough response to any question I have. The Bastian team is quick to reply to any issue I might have. As photographers, we need a team of professionals who can handle the accounting side of our businesses so that we can focus on what we do best! I am so grateful I can trust Bastian Accounting with my photography business.”

Natalie Ebaugh | Natalie Ebaugh Photography

A Letter from our founder

Meet Tiffany Bastian

I'm Tiffany Bastian, the founder of Bastian Accounting, and I'm delighted to welcome you to our financial community.

With an MBA in accounting and over two decades of experience as an IRS-certified Enrolled Agent, I'm not just passionate about numbers; I'm dedicated to bringing financial tranquility to photographers across the United States.

We're not your parents' accountant. At Bastian Accounting, we have become a crucial part of your back-end team, fostering open communication and providing support beyond compliance.

Empowerment and education are at the core of what we do. I'm here to demystify the complexities of tax codes, offer personalized strategies, and ensure you're equipped with the knowledge to make informed financial decisions.

Whether you're starting or growing your photography business, I'm excited to be your partner on this journey. Let's navigate the financial landscape with clarity, confidence, and calm.

Thank you for considering Bastian Accounting as your financial ally.

xo, Tiffany

Frequently Asked Questions

-

Absolutely! As long as you have our Legit or Legit+ we can handle both your personal and business taxes. We got you!

-

Getting started is easy! Just simply take our quiz to see if you are good fit for our one on one services.

[Take The Quiz] -

Our team specializes in serving photographers, which means we have a deep understanding of the industry's unique challenges and opportunities. We combine our expertise in accounting and tax with our knowledge of the photography business to provide tailored solutions that help our clients succeed.

-

Yes, you can switch to our services at any time. We'll work with you to ensure a smooth transition and help you transfer any necessary documents or information from your previous accountant.

-

If you've fallen behind on sales tax filings, addressing the issue promptly is essential. We specialize in getting you compliant during the onboarding process. We can assist you in catching up on your filings and developing a plan to stay compliant moving forward.

-

Starting with sales tax can be overwhelming, especially for new business owners. We're here to help! Our team can guide you in understanding your sales tax obligations, registering with the appropriate tax authorities, and setting up systems to accurately track and remit sales tax. This is all part of the Bastian Accounting Experience!