New York Sales Tax For Photographers

Many of my friends and clients in New York are photographers. One of the most common questions they ask is how to handle New York sales tax with respect to their businesses. I admit any type of tax in New York can be a head-scratcher. Even more so for a photography business.

New York Sales Tax - BASICS

Tangible & Intangible

Before we dive in any further I want to make sure you understand what tangible and intangible goods are. Tangible is a physical item you can touch or hold while intangible is not. The actual paper print photograph is tangible, the digital copy you have on your camera is intangible.

Do you need to charge sales tax?

If you sell anything tangible (albums, prints, etc…) then yes, you do.

Certificate of Authority

Next, you can register HERE for your certificate of authority to collect New York sales tax.

Sales Tax Rates

Sales tax in New York is comprised of two rates:

State Rate 4% across the board regardless of location

The county rate this varies from county to county.

For example, In Erie County, there is a 4.75% sales tax rate. Then we need to add the New York Sales tax rate of 4% to get the total tax of 8.75%. Easy so far right?

Sales tax by location

Your New York sales tax rate is calculated based on the location of your business not the location of your client or the photo shoot. Look up your rate HERE. If your business is in Erie County, your client lives in Niagara County, and the shoot is in Cattaraugus county, it is still the 8.75% from the first example. But remember, these are New York State tax laws. If your business ships out of state, New York doesn’t care, so that becomes a different topic for a different blog post.

Record Keeping

In addition to your regular recordkeeping requirements, if you collect sales tax you must keep the following detailed records:

The amount of sales tax collected, if any, on your sales

The amount of each sale along with a copy of any written sales slip, invoice, or receipt that you give your customer

The amount of any subsequent return or credit related to a sale

The jurisdiction (locality) where you made the sales or deliveries

All exemption certificates from your customers for any tax-exempt sales you made

Copies of your exemption certificates for any tax-exempt purchases you made

A daily record of all cash, debit, and credit sales

Many accounting and billing applications handle this for you. Many of my clients use QuickBooks Online which tracks all the sales tax by locations for easy filing.

Charging Sales Tax

Let’s break this down a little moreMost photography sessions include the following:

Photo Shoot & Editing

These are usually lumped into the package pricing of the photo shoot itself but is considered labor and is a professional service according to New York Sales Tax Code and is not subject to sales tax. Intangible.

Deliverables

The sale of a photograph provided and delivered electronically is not considered to be a sale of tangible personal property, and the receipts from that sale are not subject to the sales tax. This piece of it is also intangible. The sale of a photograph provided and delivered in a tangible format including by disc, photocard, tape, flash drive, etc is considered a sale of tangible personal property the receipts of which are subject to sales tax when the photograph is delivered within New York State. TSB-A-09(56)S

How to Bill

So, how do you properly invoice the client so you’re charging your client the appropriate amount of sales tax? This is where it can get a little tricky. If you bill your services and products together on the same invoice this is referred to as a “mixed” bill. This is not good practice as when you combine both tangible and intangible items on one invoice ALL OF IT BECOMES TAXABLE. In this scenario, you will be charging your client more sales tax and that increases the total cost to them of the shoot.

Let’s lower that sales tax rate AND stay compliant.

I have laid out three methods you can use for you billing that will keep you tax compliant in rank of my favorite to least favorite.

1. GO DIGITAL (My favorite) - 1 simple invoice!

Use a 3rd party digital gallery service that allows your clients the ability to order prints from their website. Sales tax and shipping responsibilities lie with them. This is the cleanest and easiest way to get away from the whole sales tax confusion (even for out of state sales).

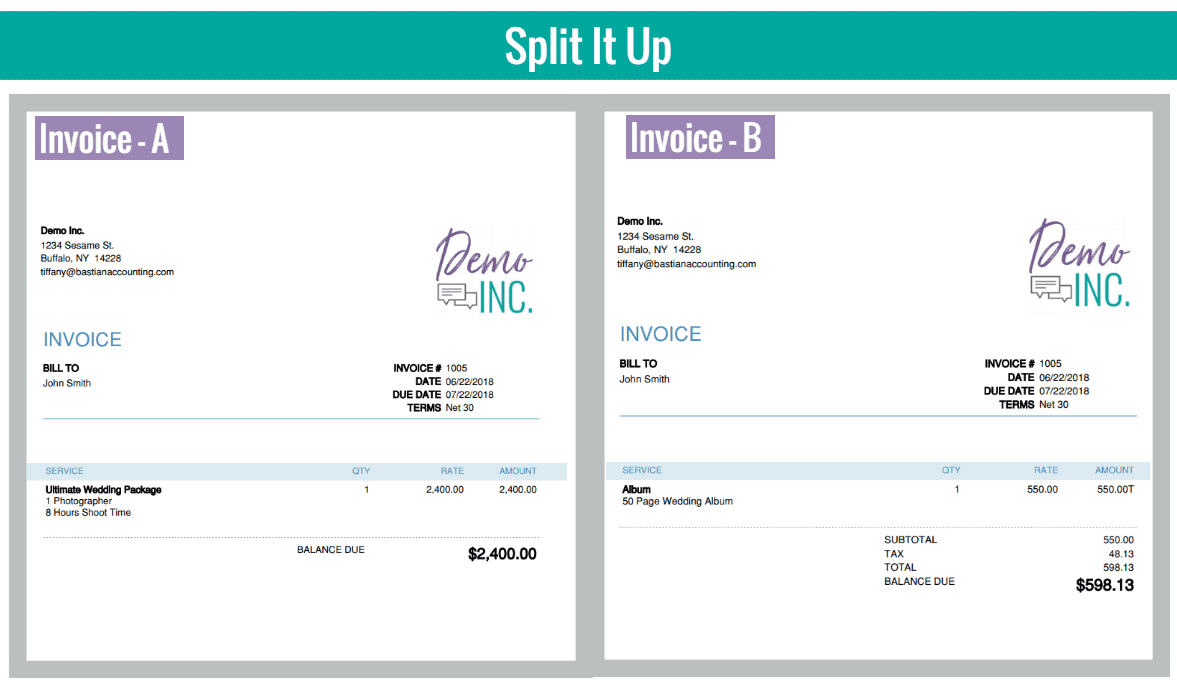

2. SPLIT IT UP (My second favorite) - Requires 2 Invoices

If that’s not your style and you want to create and handle the prints and albums (tangible) yourself, make sure you invoice them separately.

Invoice 1: The Photo shoot with no sales tax (intangible)

Invoice 2: Prints, thumb drives, albums, CD’s, DVD’s with sales tax (tangible)

If you can hold it in your hand and you are selling it to a client, it belongs on invoice 2. Make sure to take into consideration your cost and the time it takes you to create.

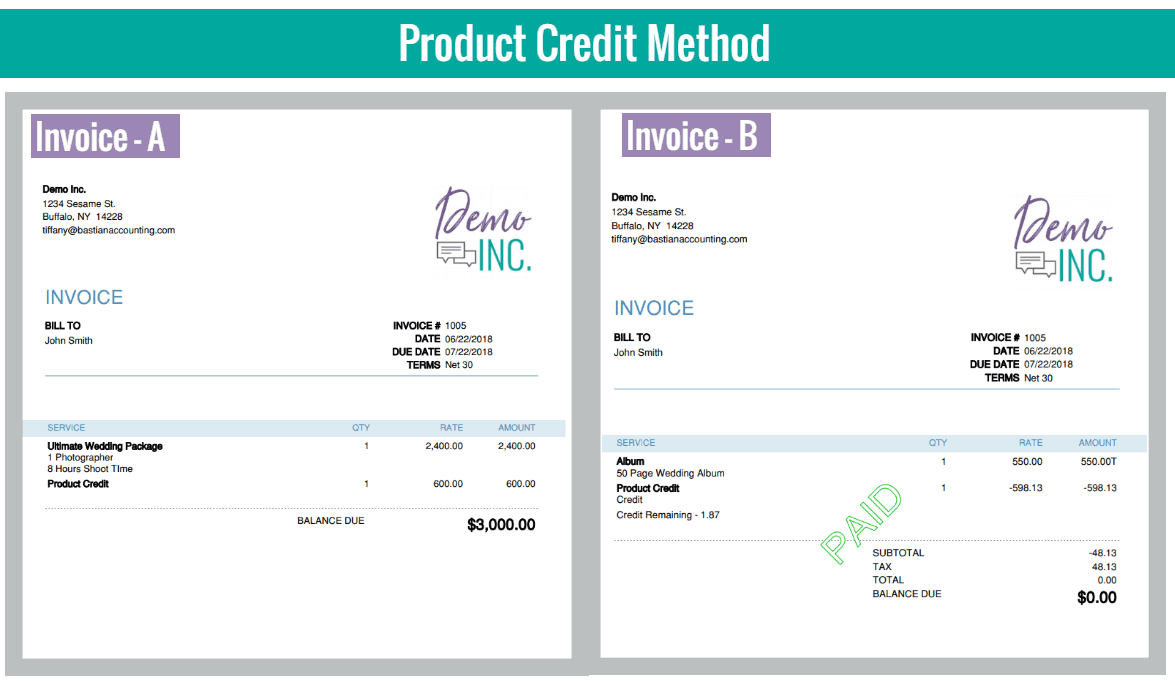

3. PRODUCT CREDIT METHOD (least favorite, extra work, it can get messy) - Requires 2 Invoices

This method allows you to bill for everything on one invoice but a portion of that invoice will be a product credit. You will simply have two lines on your bill one for the package and one for a product credit. No sales tax needs to be charged on this invoice.

When the client orders the album, books or prints you will invoice them for those items and add sales tax on that invoice. You will then apply the credit they paid for on the original invoice to this new invoice.

Think of it as a gift card if you will. You don't pay sales tax on the gift card. When you go to buy items the sales tax is added to the total and you pay with the gift card.

This can be set up a few different ways depending on what you use to do your billing… 17Hats, Dubsado, QuickBooks etc…

I want to break this down in a couple examples to show you the math behind the practice:

Example

If your package is: Ultimate Wedding - 3,000

1 Photographer

8 Hours Shoot Time

1 Wedding Album ← Aha! a tangible item is included how do you bill?

You need to know your cost on the wedding album, let's say for round number sake your cost is 400.00, next you need to figure in any time you spent working on it and mark it up so lets say 150.00 in the curation of the album. Now we are at 550.00. You will charge the client for the album + sales tax. For easy math, we will use Erie County Sales Tax (550 x 1.0875) 598.00 after tax.

Your package invoice will look like this:

Ultimate Wedding - 2400.00

Product Credit - 600.00 (this will sit on their account as a credit until they purchase the book)

When the client orders the album you will invoice them the 550 + sales tax (in this case) 598.13 and apply the 600.00 credit to it. They can use the rest of the credit to purchase other prints…

Comparison

Back to the original example if put everything on one invoice:

Ultimate Wedding - 3,000

1 Photographer

8 Hours Shoot Time

1 Wedding Album ← A tangible item, now we have to tax the whole dang thing.

Now you have to charge 3,000 x (1.0875) = 3,262.5 (that is 214.38 more in sales tax you would have to charge to put it all on the same bill).

Official Advisory Opinion

In addition to this write up I have also on behalf of all my photographer peeps submitted a form Form AD-1.8 Department of Taxation and Finance Petition for Advisory Opinion requesting an official opinion from regarding how to tread sales tax for this industry.

Once I receive the opinion we will have a standard to use so that all local photographers are consistent across the board. I will keep you posted when I hear back from the New York Department of Taxation and Finance. Many states have publication on this very topic that is easy to follow I am working on getting us the same thing for New York.

Here are a few examples other states have:

Let's get you compliant AF with your state's sales tax law so you can avoid major headaches and costly penalties down the road.

Click here to join my free Facebook Community Financially Focused Photographers

I go live in this community every week answering all your tax, bookkeeping, and tax questions!

Be sure to follow me on Instagram, Facebook, YouTube, and Pinterest.

References:

New York Department of Taxation & Finance - Advisory Opinion TSB-A-09(56)S 12-07-2009

New York Department of Taxation & Finance - Advisory Opinion TSB-A-05(34)S 09-27-2005

New York Department of Taxation & Finance - Advisory Opinion TSB-A-08(22)S 05-02-2008

New York Department of Taxation & Finance - Advisory Opinion TSB-A-12(23)S 09-20-2012

New York Department of Finance and Taxation - New York Sales Tax Representatives:

Samson Badge #62944

Jen Badge #58511