Independent Contractor 101

🛑 Be sure to check out these related posts (NEWLY UPDATED)

I get so many questions from my Photographers about independent contractors; many are unaware of exactly how all this works, and why.

Big Picture

First, let’s take a look at the big picture. For every monetary transaction that occurs, the IRS has a system to capture who is paying, who is receiving, and what taxes are paid. These systems are in place to make sure that Uncle Sam gets every possible penny he is due.

To illustrate this for you, let’s start with a situation that may be more familiar. Think back to when you were employed by someone else. When you first started the job, there was a lot of paperwork involved. One of those forms was a W-4, also known as the Employee Withholding Allowance Certificate. You filled out the W-4 based on your life situation.

The W-4 form was used to calculate and make sure that your employer was withholding and submitting the proper amount of taxes per paycheck for you. At the end of the year, your employer gave you a W-2, also known as a wage and tax statement. The W-2 is a year-end summary of all wages earned, and all taxes withheld and submitted for the tax year. The W-2 is used in preparing your tax return.

Your employer also reports that information to the IRS. The IRS then uses a Social Security number on your W-2 and matches it to the Social Security number on your tax return to make sure what you reported is the same as what your employer reported, and all taxes due have been paid. If the numbers match, you’re good. If not, you can bet you’ll be getting a letter in the mail from the IRS.

You can see how the IRS uses this process as a check to ensure everything is being reported accurately, and all the appropriate taxes are paid, so that’s the system used for employees and employers. What happens if you’re self-employed?

If you’re self-employed or pay other self-employed individuals for services, no one is withholding and submitting the necessary taxes.

The IRS still wants its cut. Before we get into it, I want to make sure you understand what an independent contractor is.

I've pulled in the IRS definition of an independent contractor.

Doctors, dentists, veterinarians, lawyers, accountants, contractors, subcontractors, public sonographers, or auctioneers who are in independent trade business, or profession in which they offer their services to the general public are generally independent contractors.

However, whether these people are independent contractors or employees depends on the facts in each case. The general rule is that an individual is an independent contractor if the payer has the right to control or direct only the result of the work and not what will be done or how it will be completed. Earnings of a person who is working as an independent contractor are subject to self-employment tax. Let's take a closer look. Those who are in an independent trade, or business, or profession in which they offer their services to the general public are generally independent contractors. You can see how you might fall in that category, or maybe some of the people you may fall into that category. Let's look at one more piece. The earnings of a person who is working as an independent contractor are subject to self-employment tax. This is where the W-9 and 1099 come into play.

Being a photographer often puts you on both sides, collecting and submitting, meaning you need to be obtaining a W-9 from the independent contractors you're paying and submitting your own W-9 to those who have paid you for services when they request.

The W-9 Form

As we discussed earlier, when you start a new job, there's a lot of paperwork to fill out, including various tax forms to make sure you're withholding enough for taxes. When you're self-employed, it works a little differently. There are different forms and processes. You still have to report your income to the IRS, and those who paid you may have to report to the IRS as well; this is why we use the W-9 and 1099 forms. Similar to the W-4 for an employee, the W-9 is collecting information. A W-9 provides personal identifying information about an independent contractor, like name, address tax identification number, and tax classification.

The W-9 acts as an agreement showing the independent contractor is responsible for paying income tax and contributing to Medicare and Social Security on their own. The business that paid you for the services will use the information on your W-9 to file a 1099 at year-end.

The 1099 Form

The 1099 form is a summary of the total amount they paid you for the tax year. You’ll receive a copy of the 1099s report on your income taxes. Those businesses will also report to the IRS. The IRS will run the 1099s against your tax return to make sure you’re claiming all the income and paying all the appropriate taxes. If not, you can bet you, too will receive a letter in the mail from the IRS. Now that you understand how the W-9 and 1099 work together let’s look at the IRS requirement for filing a 1099 form at year-end.

You can see the specific instructions from the IRS above.

File form, 1099 miscellaneous, miscellaneous income. For each person in the course of your business to whom you have paid during the year. I've highlighted the most common ones for creative entrepreneurs. Anyone you've paid at least $600 or more in rent services performed by someone who is not your employee, including parts and materials, payments to an attorney. Let's go through some examples.

Rent

You need to report anyone you pay $600 or more for rent. This could be for a studio where you conduct business, an office space, or a venue.

Services

An accountant, a business coach, marketing strategist. Do you outsource your editing? A social media manager, a second shooter, a virtual assistant, a website designer.

Attorney

Any fees you pay to an attorney. If you hire an attorney to review a contract or help you write your contract, or to file an LLC for you, or help you with any other type of legal matter concerning your business, you need to report those fees too if they are $600 or more.

Exceptions

There are some exceptions. Before we go too far, let’s take a look at those. Some payments do not have to be reported on the Form 1099 miscellaneous. Although, they may be taxable to the recipient. Payments for which a form 1099 is not required include all of the following; generally payments to a corporation, including a limited liability company that is treated as a C or S corporation. However, see reportable payments to corporations.

Reportable payments to corporations tell us the following payments made to corporations generally must be reported on form 1099 miscellaneous.

You see the list here, but the one that affects most photographers would be the attorney fees. This means that you need to report all payments to an attorney regardless if they are an S or C corporation.

Now, let’s cover penalties and fines for not reporting 1099s as required.

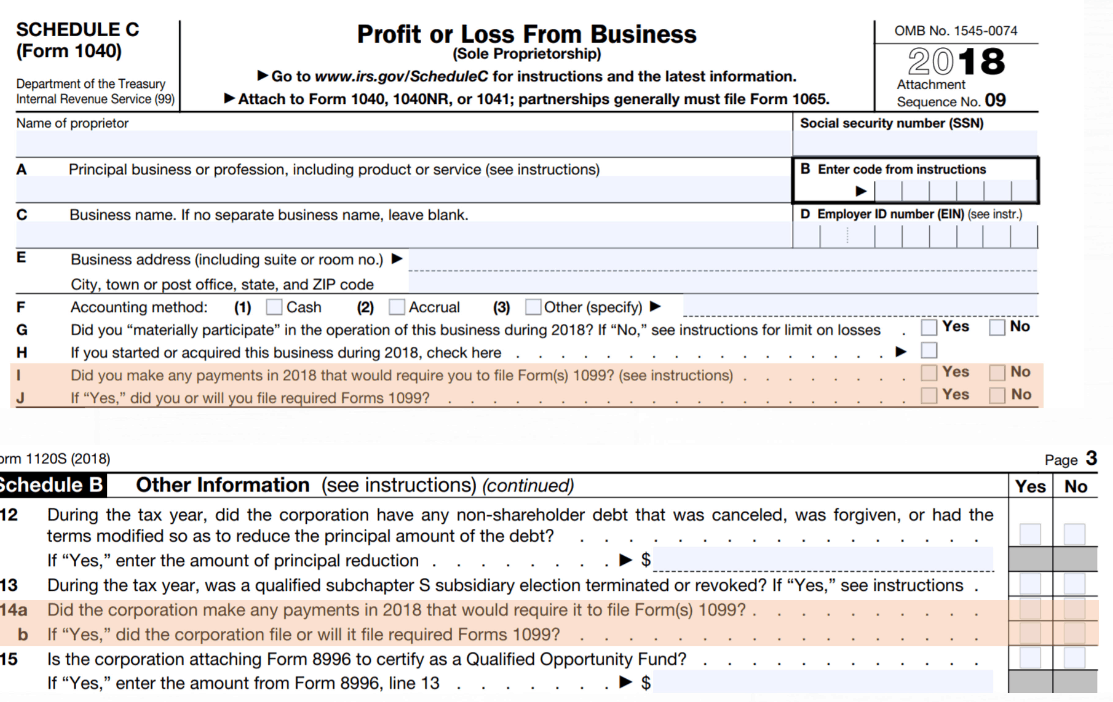

As the IRS continues to enforce 1099 compliance by small businesses, the risk of not filling out those forms is too great. In fact, the IRS now asks you to answer these two questions on all federal forms. Question one, did the corporation make any payments in the year that would require it to file forms 1099? Question two, if yes, did or will the corporation file required form 1099? You can see below that question being asked here on the schedule C, and also, on the S corporation return, the 1120-S. By responding to these questions on your return, you are indicating under penalty of perjury that your tax return is accurate and complete, including all 1099 filing requirements.

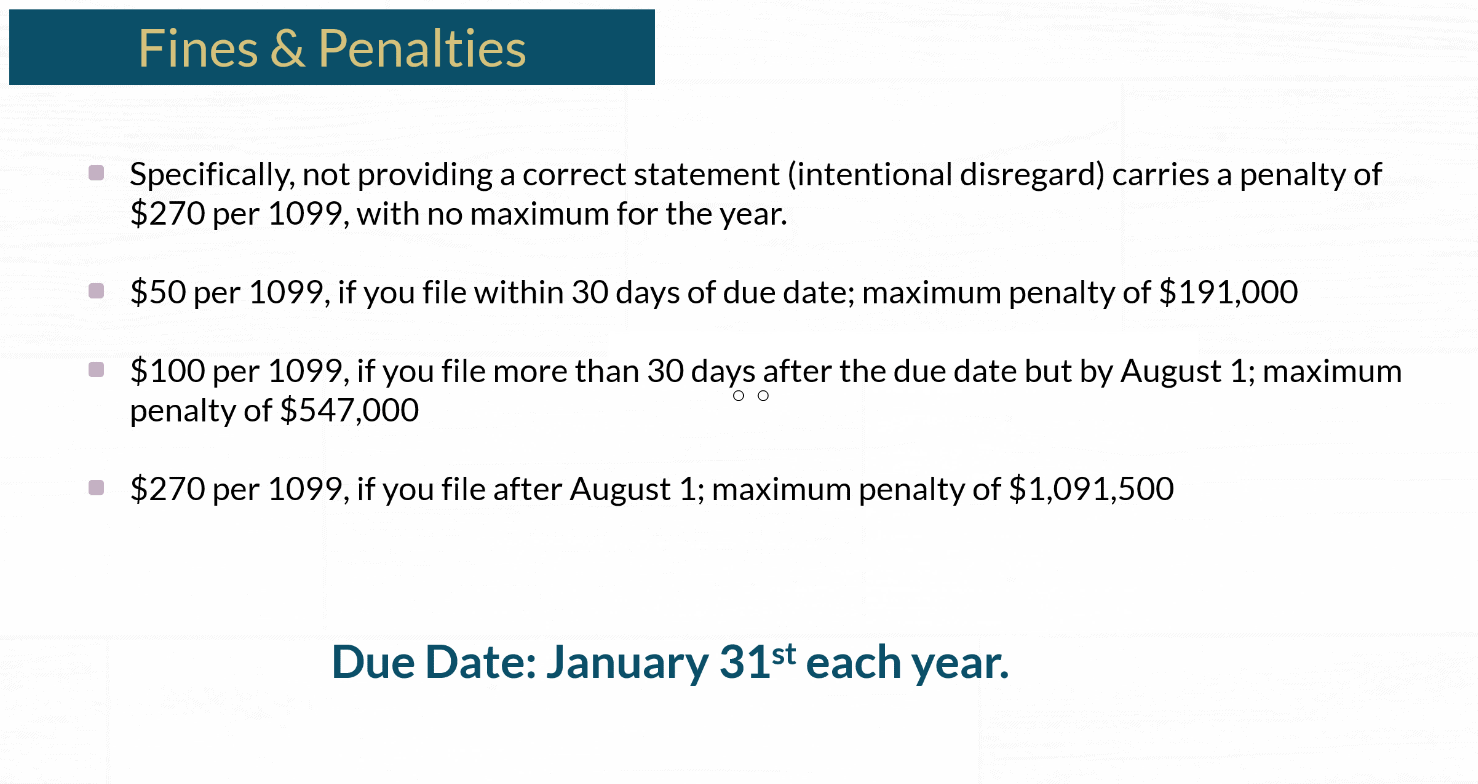

It pays to mind the tax filing deadlines as well. Late filings are mandatory. In fact not providing a 1099 on time could lead to penalties ranging from 50 to a hundred dollars per 1099 with a maximum of $547,000 a year for your small business. The amount of the penalty is based on when you file the correct information as follows; specifically not providing a correct statement, and intentional disregard carries a penalty of $270 per 1099 with no maximum for the year. $50 per 1099 if you file within 30 days of the due date. Maximum penalty, $191,000. A hundred dollars per 1099 if you file more than 30 days after the due date, but by August 1st maximum penalty $547,000. $270 per 1099 if you file after August 1st. Maximum penalty, $1,091,500.

Due date, January 31st, each year. Very important date to know so that you don’t face any of those penalties.

So, what does this all mean?

How do you know if they're an S corporation or a C corporation?

How do you know if you need to track it?

How do you know if you need to report it?

Best Practices

Let's walk through the best practices that I have to help you create a process for yourself.

Get W-9 first

Anytime you engage in a business relationship with someone who is self-employed, the best practice is to have them fill out and sign a W-9 upfront before they do any work for you. This ensures you are compliant and have the information you need should they meet filing requirements.'

Use the W-9 information to determine their tax classification. This will tell you if you need to track payments to them. Section three of the W-9 form has the tax classification. If they have checked off C corporation, or S corporation, or have entered an S or a C in the limited liability field, there is no need to track them unless they're an attorney. Remember, it does not matter if an attorney is a corporation or not.

Keep W-9 On File

You still must have a W-9 on file, and report all payments $600 or more. If they're an S or C corporation, you'll still want to keep the W-9 on file as proof of tax classification. If you're ever audited down the road, or have a question about anything, you have a W-9 that shows they marked off that they were a C corporation or a S corporation, therefore, you did not need to file anything.

Track Payments

If they're not an S or C corporation, you'll want to set them up to be tracked. I do this inside of QuickBooks Online. The W-9 also serves as a contract that shows the contractor agrees that he or she is responsible for reporting the income and paying the self-employment taxes on it, not you. You can see how valuable having a signed W-9 on file is. I can already hear so many questions coming.

Frequently Asked Questions

I want to go over the top two questions I get every single year numerous times from my creative entrepreneurial clients and share the answers with you.

"What if I request a W-9, and they do not respond or refuse?"

There is a $50 penalty for not providing a W-9 upon request. You're still responsible for reporting with as much information as you have on the person.

You'll leave the tax identification number field blank, and check off a box, Refused To Provide if you're filing electronically, or if you're filing manually, you'll write that on the top of the 1099 form. The IRS will then send a notice requiring you to begin a 24% backup withholding for the payee. The loss will be required to make at least three attempts over the next two years to access the information from the company. Be sure to document the attempts for your records in order to avoid penalties from the IRS for you. The letter from the IRS will explain that if you engage in any future business with the contractor, you will be responsible for their backup withholding. This is because the IRS assumes they will not provide you with a W-9, because they're trying to avoid taxes.

So, the IRS makes you responsible for withholding 24% of what you pay the contractor, then you will need to report and submit it to the IRS on their behalf. Once they provide you with a W-9, you can discontinue backup withholding, but the best practice is, get the W-9 upfront, and do not engage in business with those who will not comply.

"But I'm not going to pay them more than $600. Do I still need a W-9?"

I hear this all the time. Again, the best practice is to get the W-9 upfront and not engage with business with those who will not comply. Having that W-9 sign covers your butt, you are compliant from the get-go, and you don't have to worry about anything after that.

Have another question you’d like me to add to this list?

Click here to join my free Facebook Community Financially Focused Photographers

I go live in this community every week answering all your tax, bookkeeping, and tax questions!

Be sure to follow me on Instagram, Facebook, YouTube.

If you’re ready to get your financial sh!t together --> WORK WITH US!

Photo by Marvin Meyer on Unsplash