Should You Use Dubsado & QuickBooks Online Together?

To QBO or Not to QBO…

A question a lot of dubsado users are asking is “how do I know when or if I need QuickBooks” My answer… it depends on your business and your goals.

Dubsado

Dubsado will track the income that you invoice out and the expenses that you manually enter, which will produce a simple profit & loss statement. This simply lists your income minus your expenses and gives you the difference. This difference is known as your net income (this is the number you are taxed on).

For someone just starting out or with a very simple business model this is perfect. (Keep in mind there are big things coming to Dubsado to beef up this feature and eventually integrate it with QuickBooks Online)

When would you need more?

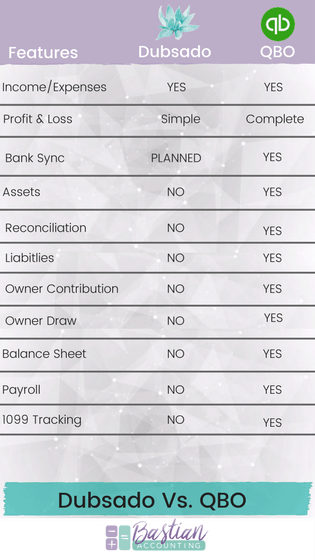

Dubsado vs QuickBooks Online

As your business becomes more intricate and you purchase equipment, open a business credit card or take a small business loan you should start thinking about a more dedicated accounting app to capture all the financial data for your business. If you ever plan on paying yourself from your business you will definitely need a more robust accounting app.

There are several cloud-based apps out there you can try. But, I recommend QuickBooks Online; not only do I use it for my own business but this is what I use for all of my clients as well.

Here is a quick comparison List (I will break each of the features down below):

Income/Expenses

This is pretty simple the income you from your services and the expenses that you spend on business related items.

Profit & Loss

A profit and loss is made up of your income minus expenses. However, there are a few different types of income and expenses. For example, if you receive credit card rewards or interest from a savings account that is other income. If you had to pay penalties or fees for something those are other expenses. If you have to purchase goods that you resell or part you put together to create an item you sell those are the cost of goods sold and should be in their own section of the profit and loss. QuickBooks will produce a complete profit and loss.

Bank Sync

QuickBooks can sync right to your business bank, credit card and loan accounts and download the activity and puts it in a sort of purgatory. You then go in and categorize the transactions and voila you're done with a few clicks.

Assets

If you purchase equipment for your business from cameras to vehicles, computer furniture. (The equipment you purchase depends on the type of business you run) all of the types of items are assets and need to be tracked on a balance sheet. The value of these items helps create the dollar value your business is worth. These items all need to be tracked for depreciation on your taxes.

Reconciliation

This is when you compare an account with the bank records line by line (done on a monthly basis) to be sure your records are accurate and nothing was missed. QBO has an awesome reconciliation tools to help you do just that.

Liabilities

These are items you owe money on, maybe a loan or lease for some equipment, or a business vehicle loan or simply the balance of a business credit card.

Owner Draw

If you are an LLC or Sole Proprietor you are not allowed to pay yourself payroll. The only way you can pay yourself is via an Owner’s Draw. This goes on the balance sheet and plays into the overall equity.

Owner Contribution

If you purchase items out of your pocket sometimes instead of your business account (we all know how often this happens)we account for this with Owner Contributions.

Balance Sheet

This is a financial report that lists the Assets, Liabilities and Equity. If you are applying for a loan you will need full financial statements which includes a Balance Sheet.

Payroll

If you ever convert to an S-Corporation for tax savings or hire anyone you will want to have an app that can handle QuickBooks is awesome for this.

1099 Tracking

Anyone you pay for a service, rent or legal counsel who is not a corporation must be tracked. This is a big one I find many small business owners do incorrectly due to lack of knowledge on who to track. You are required to file a 1099 for each of these people if you pay them over 600 in a tax year. (you must also collect a W9 from them and keep it on file) Tracking this information is crucial for your tax reporting requirements. QuickBooks has a great system set up for you to track these types of payments.

Need More?

I hope this helps you consider what you need for your own bookkeeping and accounting needs. If you would like to break up with your bookkeeping, CLICK HERE.

Click here to join my free Facebook Community Financially Focused Photographers

I go live in this community every week answering all your tax, bookkeeping, and tax questions!

Be sure to follow me on Instagram, Facebook, YouTube, and Pinterest.